can you buy a house if you owe state taxes

Yes you can sometimes get the loan that you need to buy a home even if you have a tax debt and owe taxes. In tax deed states the homeowner does not have the option to buy back the property as she does in a tax lien state.

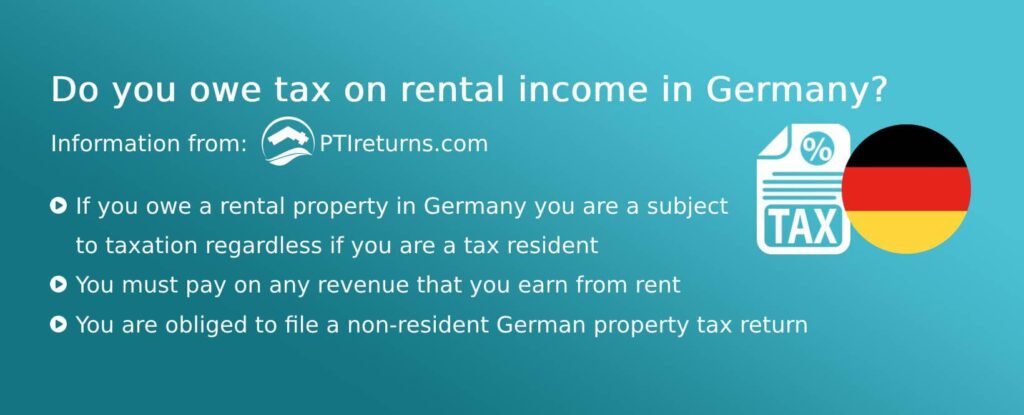

German Rental Income Tax How Much Property Tax Do I Have To Pay

While its possible to buy a home if you owe taxes there are a few things you should know about getting a mortgage under these circumstances.

. The long answer is that whether you will get the mortgage has less to do with the IRS and more to do with your lenders guidelines. As an example lets say an individual bought a house for 200000. The easiest option is to pay off your tax debt before you apply for a mortgage.

If you want to avoid the issue altogether it might be best to pay off tax liens before you fill out a loan application. A tax debt doesnt equal a blanket rejection for a mortgage application. You can avoid tax liens by communicating with the IRS and paying your taxes through an installment agreement or.

Generally you can purchase a home at a tax sale for the amount of taxes owed on it if you can outbid other hopeful purchasers. If you want to buy a home for your own use or for renovation and resale head to a tax deed state to do so. However this wont always be the case and owing tax certainly makes it a lot more difficult to secure a.

Ad Use our tax forgiveness calculator to estimate potential relief available. Getting approved for a mortgage in this situation has less to do with the IRS and more with the individual lender. In general your likelihood of being approved for a home loan varies based on your individual circumstances but any type of debt added to your borrower profile can make you a riskier applicant in the eyes of a lender.

Check Your Eligibility for a Low Down Payment FHA Loan. Typical deductions include. If you owe taxes it may be harder for you to get approved for a conventional mortgage.

Youll need to first learn about and understand. The High Court has consistently ruled the sales are legal. If you owe other kinds of taxes like property tax or state tax you might still be able to get approved for a mortgage.

This could involve working with a tax professional like an Enrolled Agent at Larson Tax Relief to make arrangements with the IRS or your state tax authority to resolve unpaid tax debt. While owing state taxes makes the buying process challenging for taxpayers you can buy your dream home. So if you buy a 500000 home there youll owe a transfer tax of 5000 to the state and another 15000 to the town.

Say a house costs 200000. FHA loans can be more forgiving of tax debt if you can prove you have a plan to pay it off. The proposed tax credit was introduced in 2021.

Even states that dont have sales tax can have real estate transfer taxes. Having tax debt also called back taxes wont keep you from qualifying for a mortgage. Yes these property tax auctions are legal.

You would need at least 15000 for both items. If youre in the market to buy a home while dealing with unpaid taxes you might be wondering if your tax debt will affect your mortgage approval. Well begin by answering your key question.

Tax liens from unpaid taxes can make the process of buying a house more complicated or even impossible but you still have options. If youre looking to buy a house while you have a federal tax debt you may have a more difficult time getting a mortgage. If this kind of investing were not safe no one would attend the auctions and spend their money.

In short yes. Then you deduct the home sale exclusion. But making the process as seamless as possible will require strategic planning on your behalf.

The amount you pay in property taxes is deductible on your federal income taxes up to a limit of 10000 if youre married and filing jointly or 5000 if youre single or married and filing separately. This means that you first deduct the price you paid for the house then you remove any tax-deductible improvements or expenses. Can you still buy a house.

However there are some limited exceptions to this general rule in which a tax lien will be filed for a lower amount of liability. The IRS will typically not file a tax lien unless the liability is over 10000 but on the plus side as of late the IRS has eased up on this and has generally increased this threshold to 25000. If You Owe the IRS Can You Buy a House.

The First-Time Homebuyer Act of 2021 provides for a credit equal to 10 of the purchase price of your home up to a 15000 limit 7500 for married filing separately. Are your dreams of owning a home dashed if you have tax problems. The short answer is yes.

As a cash buyer this is a deduction you could claim. The short answer is that owing the IRS money wont automatically prevent you from qualifying for a home loan. Its still possible but youll be seen as a riskier borrower.

This will set off warning bells for any lender who may see it as a risk to approve you for a mortgage. The US Supreme Court has a long history of ruling on past due property tax collection efforts. Ad Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford.

Depending on your situation you may be able to buy a house while you owe taxes. Take the First Step Towards Your Dream Home See If You Qualify. If you cant pay your tax debt it doesnt mean the IRS will automatically file a tax lien so you wont be able to purchase a home.

If you owe the federal government taxes theyve likely put a lien on your possessions or current property. As the name implies you must be buying your first home to qualify. While you must perform the same due diligence as needed in tax lien situations there is some extra work involved.

If youre trying to get approved for a home loan while in tax debt there are things you can do to prove youre in good standing and will not be in danger of defaulting on a mortgage. If you want to buy a house you will need to save money for the down payment and for the closing costs. The answer can depend on your particular situation.

In Delaware where theres no state sales tax real estate transactions can be subject to a transfer tax of 3 of the property value. But you also need to provide the lender with proof of your current income and a copy of your tax return to prove you are a qualified borrower. Whatever is left is the amount which you owe taxes on.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. You havent paid your taxes over the past few years and you do owe a significant amount of back taxes to the IRS. But you may have to actively work on the tax debt before a bank will approve a home loan.

While it will make things more difficult you can buy a house while owing taxes. The good news is you can buy a house even if you owe tax debt. It will take some hard work on your part though and the road wont be as straightforward as it will be for someone who doesnt owe money in back taxes.

If you owe taxes to the state you can still buy a house if you convince a lending institution to approve your application or offer a cash payment. You can then use your escrowed funds to buy. NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Ad First Time Home Buyers.

German Rental Income Tax How Much Property Tax Do I Have To Pay

Tax Organization Tax Organization Money Saving Mom Finance Saving

Don T Count On That Tax Refund Yet Why It May Be Smaller This Year

Will I Be Able To Buy A House If I Owe Taxes Loans Canada

2022 Tax Deadlines And Extensions For Americans Abroad

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Can You Get A Mortgage If You Owe Back Taxes Yes But

How To Find Tax Delinquent Properties Real Estate Investing Org Real Estate Investing Rental Property Real Estate Investing How To Buy Land

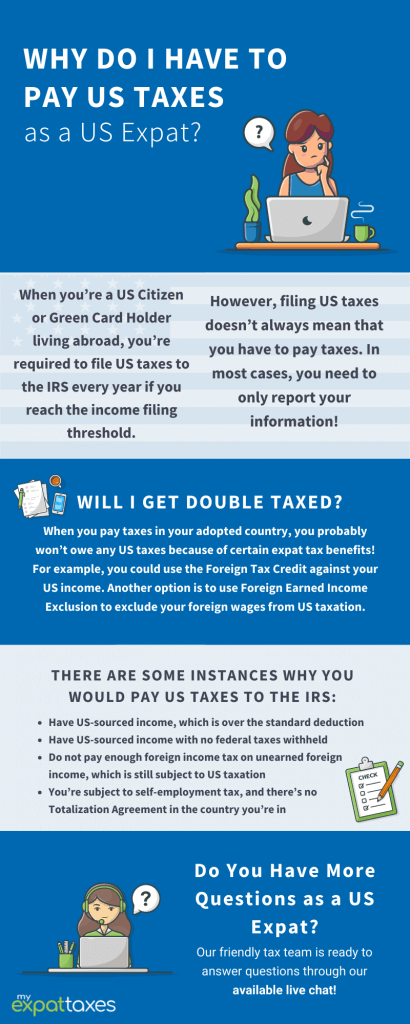

Paying Us Expat Taxes As An American Abroad Myexpattaxes

Income Tax In Germany For Expat Employees Expatica

Net Worth Calculator Balance Sheet Assets And Liabilities Etsy Excel Spreadsheets Balance Sheet Check And Balance

What To Do If You Owe The Irs Back Taxes H R Block

German Rental Income Tax How Much Property Tax Do I Have To Pay

What You Shouldn T Do If You Owe The Irs Smartasset

Can You Buy A House If You Owe Taxes Credit Com

Your Taxes Are Due Federal Income Tax Income Tax Return Income Tax

Pin By Nicole Ob On Teaching In Sweden Teaching Owe Taxes When You Leave

Free Income Tax Calculator By Cleartax An Online Tax Calculation Tool That Tells You How Much Income Tax You Owe To The Income Income Tax Online Taxes Income